Forex Market Clock For Mac

You can make money trading when the market moves up, and you can even make money when the market moves down. BUT you will have a very difficult time trying to make money when the market doesn’t move at all. And believe us, there will be times when the market is as still as the victims of Medusa. This lesson will help determine when the best times of the day are to trade. Forex Market Hours Before looking at the best times to trade, we must look at what a 24-hour day in the forex world looks like.

The forex market can be broken up into four major trading sessions: the Sydney session, the Tokyo session, the London session, and Pipcrawler’s favorite time to trade, the New York session. Below are tables of the open and close times for each session: Spring/Summer in the U.S. (March/April – October/November) Local Time EDT BST (GMT+1) Sydney Open – 7:00 AM Sydney Close – 4:00 PM 5:00 PM 2:00 AM 10:00 PM 7:00 AM Tokyo Open – 9:00 AM Tokyo Close – 6:00 PM 8:00 PM 5:00 AM 1:00 AM 10:00 AM London Open – 8:00 AM London Close – 4:00 PM 3:00 AM 11:00 AM 8:00 AM 4:00 PM New York Open – 8:00 AM New York Close – 5:00 PM 8:00 AM 5:00 PM 1:00 PM 10:00 PM Fall/Winter in the U.S. (October/November – March/April) Local Time EST GMT Sydney Open – 7:00 AM Sydney Close – 4:00 PM 3:00 PM 12:00 AM 8:00 PM 5:00 AM Tokyo Open – 9:00 AM Tokyo Close – 6:00 PM 7:00 PM 4:00 AM 12:00 AM 9:00 AM London Open – 8:00 AM London Close – 4:00 PM 3:00 AM 11:00 AM 8:00 AM 4:00 PM New York Open – 8:00 AM New York Close – 5:00 PM 8:00 AM 5:00 PM 1:00 PM 10:00 PM Actual open and close times are based on local business hours, with most business hours starting somewhere between 7-9 AM local time. Open and close times will also vary during the months of October/November and March/April as some countries (like the United States, England and Australia) shift to/from daylight savings time (DST). The day of the month that a country shifts to/from DST also varies, confusing us even more. And Japan doesn’t observe daylight savings, so thank you Japan for keeping it simple.

Now, you’re probably looking at the Sydney Open and wondering why it shifts two hours in the Eastern Timezone. You’d think that Sydney’s Open would only move one hour when the U.S. Adjusts for standard time, but remember that when the U.S.

Forex Clock App

Shifts one hour back, Sydney actually moves forward by one hour (seasons are opposite in ). You should always remember this if you ever plan to trade during that time period. Also take notice that in between each forex trading session, there is a period of time where two sessions are open at the same time. During the summer, from 3:00-4:00 AM ET, for example, the and overlap, and during both summer and winter from 8:00 AM-12:00 PM ET, the London session and the session overlap. Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. This makes sense because, during those times, all the market participants are wheelin’ and dealin’, which means that more money is transferring hands. Now let’s take a look at the average pip movement of the major currency pairs during each forex trading session.

Pair Tokyo London New York EUR/USD 76 114 92 GBP/USD 92 127 99 USD/JPY 51 66 59 AUD/USD 77 83 81 NZD/USD 62 72 70 USD/CAD 57 96 96 USD/CHF 67 102 83 EUR/JPY 102 129 107 GBP/JPY 118 151 132 AUD/JPY 98 107 103 EUR/GBP 78 61 47 EUR/CHF 79 109 84 From the table, you will see that the London session normally provides the most movement. Notice how some currency pairs have much larger pip movements than others. Let’s take a more in-depth look at each of the sessions, as well as those periods when the sessions overlap.

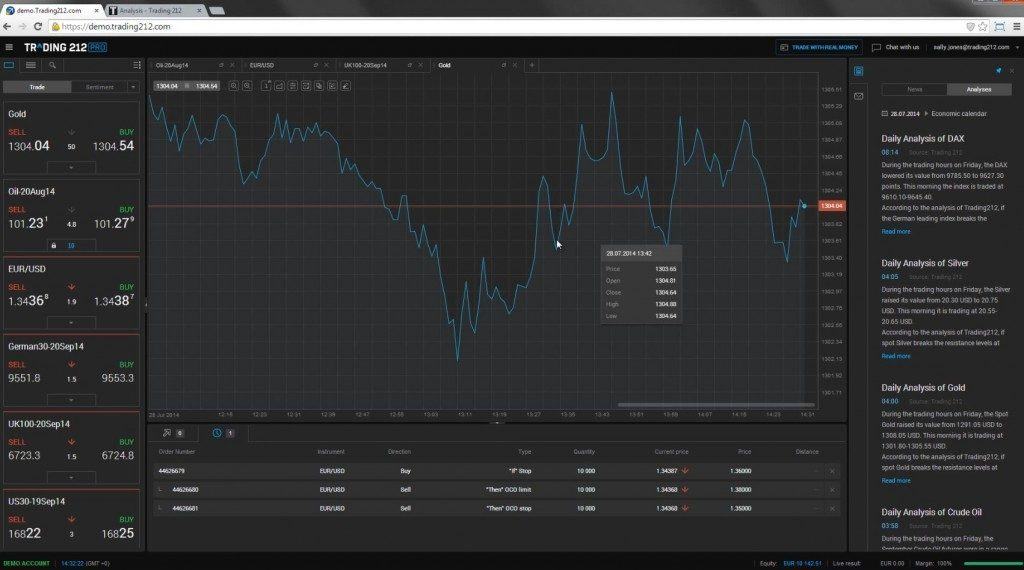

Millions of traders with a wide range of needs choose MetaTrader 4 to trade in the market. The platform offers ample of opportunities to traders of all skill levels: advanced technical analysis, flexible trading system, algorithmic trading and Expert Advisors, as well as mobile trading applications. And additional services extend MetaTrader 4 frontiers. The Signals service allows you to copy trades of other traders, while the Market provides you with various Expert Advisors and Technical indicators that you can buy.